When first considering your investment options, many people decide to utilize a 401(k) for their retirement plans. This is often due to an appealing employer's plan for company matching. Unfortunately, if you leave the company where your 401(k) resides for any reason other than retirement, you'll need to take action regarding 401(k) rollover. Here, we'll discuss a common 401(k) rollover option: how to roll over your 401(k) to an IRA.

What is a 401(k) Plan?

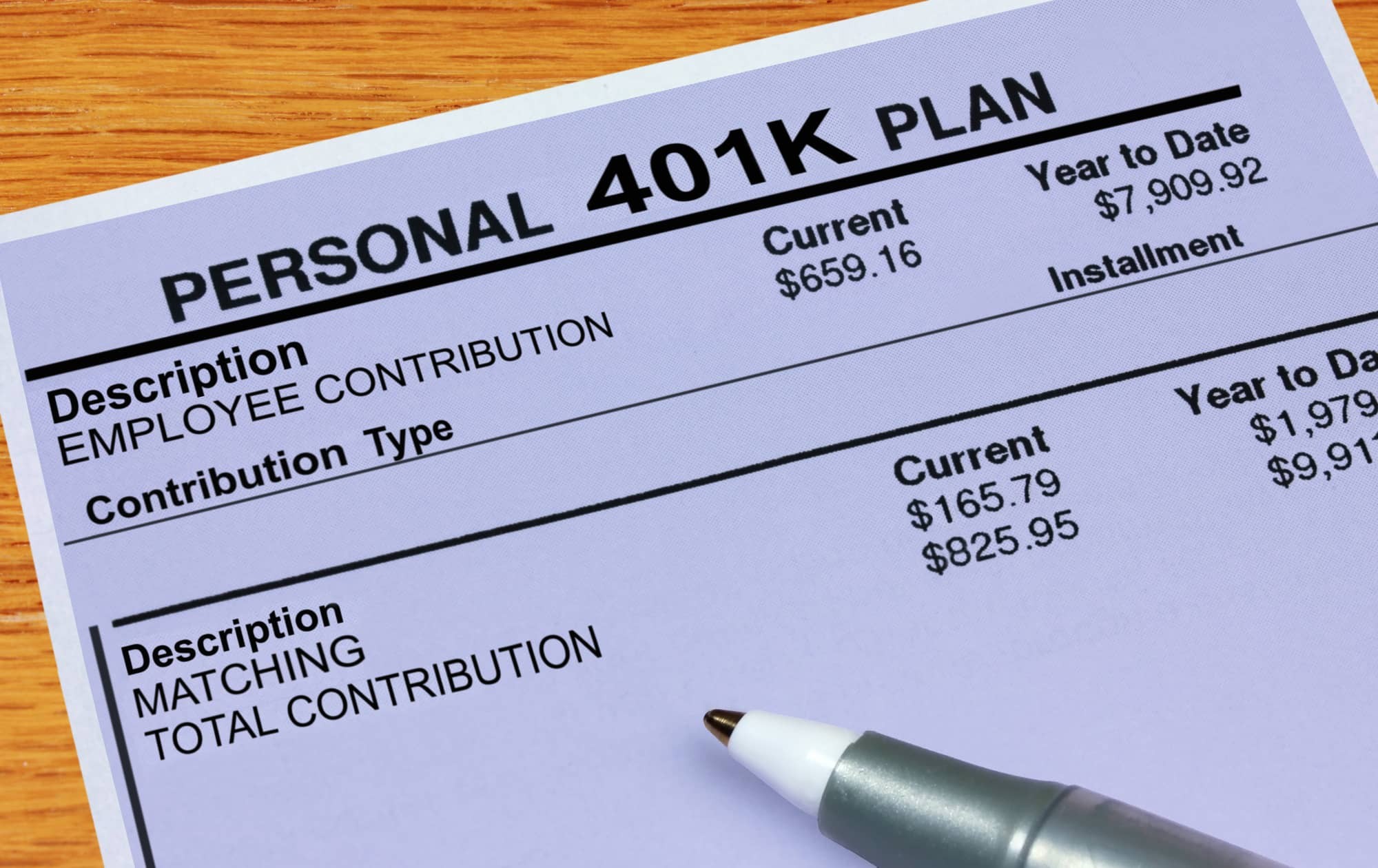

A 401(k) plan is a retirement account that capitalizes on tax-free contributions. Employees can have direct contributions withdrawn from their paycheck through automatic processing. The money invested is often matched by the employer and is not taxed until the employee withdraws it. This is one of the things that make 401(k) plans appealing as a retirement account. Contributions to a 401(k) should remain in the investment account until after retirement for the highest yield and in order to avoid incurring a withdrawal penalty.

What is an IRA?

An IRA investment account is another way to help strengthen your retirement plan. There are three primary types of IRAs: a traditional IRA, Roth IRA, and a rollover IRA.

Traditional IRA

A traditional IRA is when you make contributions using money that can be tax-deductible. The earnings then grow tax-deferred until you withdraw the money. This is beneficial as retirees are often in a lower tax bracket, meaning that withdrawal benefits include money taxed at a lower rate.

Roth IRA

A Roth IRA is an individual retirement account where you make contributions with money that's already been taxed. This allows for your contributions to continue growing tax-free. Adhering to specific rules for your retirement plan means that this money can be withdrawn tax-free as well.

Rollover IRA

A rollover IRA is when you take money from an old 401(k) or another qualified retirement account into a traditional IRA. Contributions can also come from qualified 403(b) plans.

Benefits of a 401(k) Rollover

There are plenty of benefits of rolling over your 401(k), but most of these benefits are based on the assumption that you're nearing retirement and you're at the age where it's a smart financial move. If your investments are still young, or you're still employed at the same job, you can keep your 401(k) and continue to utilize the employee matching programs available.

Stronger Investment Options

Since your 401(k) is limited in terms of investment opportunities, rolling it over into an IRA can give you more chances for diversification. IRAs allow for investments in a variety of stocks, bonds, cash funds, mutual funds, ETFs, and more.

Increased Communication

If you're leaving your old employer and you maintain the 401(k) under their name, you might face a few problems with communication. For one, it will be more difficult to get information on the status of your plan and harder to reach support staff. Plus, if anything happens to your previous employer, your 401(k) may be frozen until things are sorted out. This can be especially problematic in the case of employer bankruptcy.

Lower Fees

If you're paying for your own retirement accounts, an IRA investment has lower fees than a 401(k). You won't have to cover the same number of management or administration fees and you'll avoid unnecessary annual fees. As the age of your accounts increases, the fees can really add up. IRA management often falls under one umbrella

The Option for a Roth IRA

When you rollover your 401(k), you have the option to transfer funds into a Roth IRA. This is a good way to increase the diversification of your accounts and reduce the amount of tax due upon withdrawal later on, which can have a substantial impact on your overall retirement savings. However, if you believe you're going to be in a higher tax bracket at the age of retirement, it makes more sense to contribute to a traditional IRA now.

Cash Incentives

Depending on the broker or financial advisor that you use for your rollover, you may be given additional benefits. While some companies use cash as an enticing offer, others may include free trades or different benefits. Always discuss your options prior to making any decisions and if it seems too good to be true, check references or continue to interview alternatives.

Fewer Compliance Issues

Managing an IRA means that you won't have as many compliance issues overall. Since the regulations are created, monitored, and standardized by the IRS, the parameters are straightforward, and things won't change from broker to broker. This, in the long run, results in fewer compliance issues. Many people find that they also have more control with payout options when utilizing an IRA in compared to a 401(k).

Keeping Your Current 401(k) plan

In some instances, the 401(k) plan administrator, or your previous employer, may allow you to keep funds in your retirement plan after you leave. While it's beneficial to have this option available, it's not always the right move. The primary reason for such behavior is if your new employer doesn't provide or offer any 401(k) plans, or if the plan they do offer is far less beneficial. This allows you to maintain the performance of your current 401(k) plan and be protected from any legal problems that may come. Again, every employer is different, so always discuss your options before making any decisions. For more information on how to manage your 401(k) account held with prior employees, or for advice on your specific circumstances, consider working with a financial advisor.

If you're struggling to decide whether or not you should keep your current 401(k) plan or roll it over into an IRA retirement account, contact me, William Bevins today. As an experienced financial advisor, he works using individualized information to make the best decision for your age, type of retirement plans, and overall investment goals. To schedule a consultation, contact William Bevins today at [email protected] or by calling (615) 469-7348.