There are various options available to save for retirement, which can assist in achieving your goals. A familiar option for many people is a 401(k) plan provided by their employer.

How Do Interest Rates Work?

Interest rates are the heartbeat of the financial world, influencing everything from your savings account to the global economy. But what exactly are they, and how do they work?

What is a backdoor ROTH IRA?

Understand the concept of a backdoor ROTH IRA and how it can amplify your retirement savings with strategic financial planning.

Selecting a Fiduciary Financial Advisor: Unlocking Benefits for Your Retirement Planning

Explore the process of selecting a fiduciary financial advisor and highlight the benefits of working with one, focusing on the expertise of William Bevins, CFP, CTFA.

What is a ROTH IRA?

Learn the advantages of a ROTH IRA and how this tax-advantaged retirement account can play a crucial role in securing your financial future.

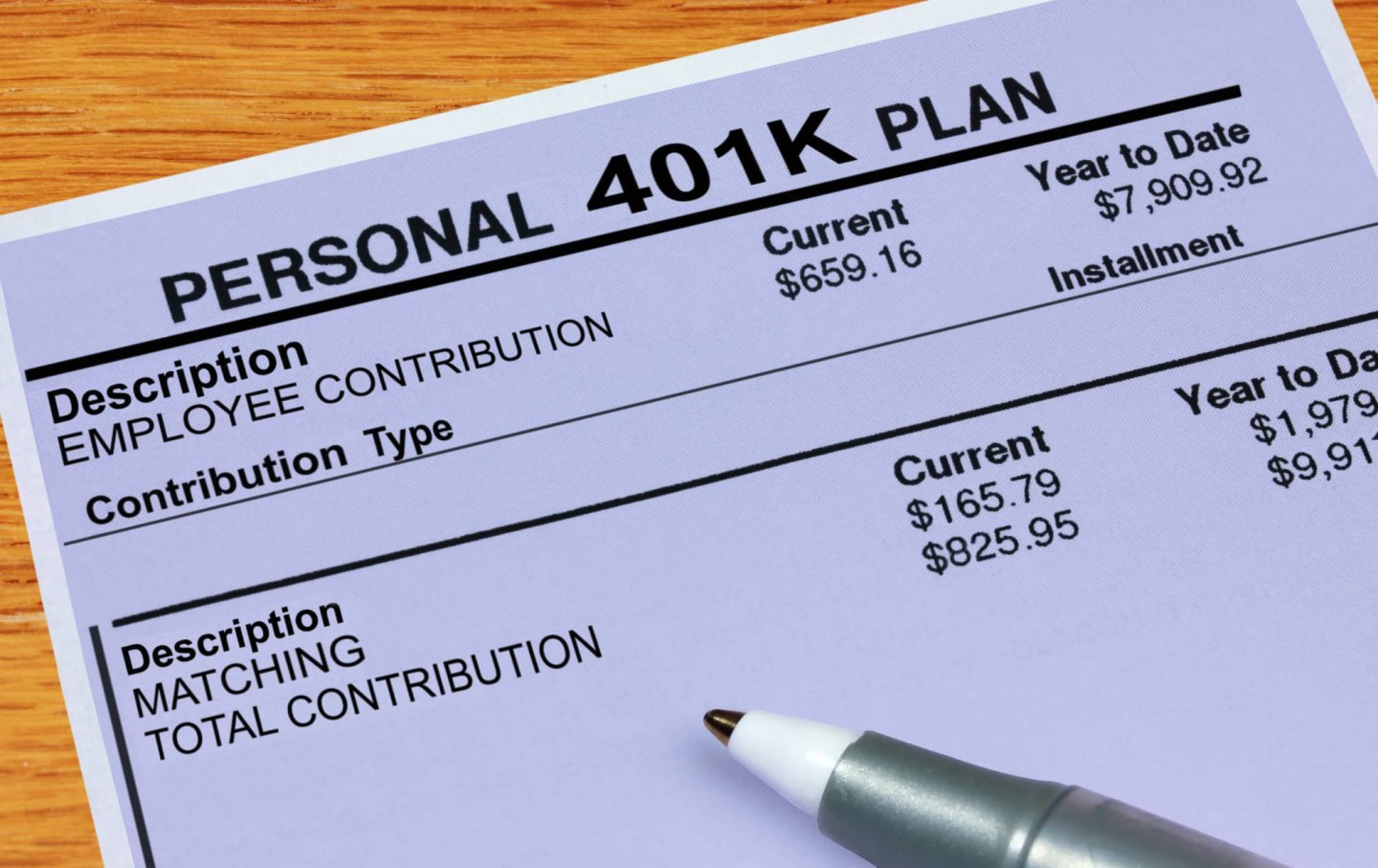

401(k) Rollover Options: How to Roll Over Your 401(k) to an IRA

When first considering your investment options, many people decide to utilize a 401(k) for their retirement plans. This is often due to an appealing employer's plan for company matching. Unfortunately, if you leave the company where your 401(k) resides for any reason other than retirement, you'll need to take action regarding 401(k) rollover.

What Is a Fiduciary Financial Planner and How They Are Different?

You may have heard that a fiduciary financial planner is required to act in your best interest. But what

does that actually mean for you?

What is Passive Investing?

This is the beauty of passive investing, a strategy employed by the patient, the prudent, and those with a profound appreciation for the subtleties of the market's ebb and flow.

What is a SEP IRA?

SEP IRA is a valuable tool for retirement planning and wealth creation over ones lifetime.