Compound interest is an important part of wealth management and saving for retirement.

What is a health savings account?

Health savings accounts can be an effective tool for building wealth and providing security for later in life. For many however, health savings accounts can be complex and difficult to understand.

Gearing Up for Inflation… Helpful ideas to protect your portfolio.

It's been many years since the US economy has experienced meaningful inflationary pressure.

Considering the record amounts of stimulus and deficit spending that is taking place in 2020,

now may be the right time to “inflation-proof” your investments.

Investment Planning During Uncertain Economic Times

If you invest long enough, at some point in time, the world gets turned upside down.

How to Write a Comprehensive Financial Plan

If you want to achieve your financial goals, creating a comprehensive plan for success is essential.

Eight Things You Never Knew About Estate Planning

Estate planning is an action that’s not always at the top of someone’s to-do list. While it might not seem like an urgent act, you never know what could happen and it’s always better to be over prepared than under prepared. If you have any preferences for how your assets will be handled if you were to pass away or become incapacitated, estate planning is essential.

How to Protect Yourself Against IRS Audits

Spending time working on your taxes can be a scrutinizing task, especially if you’re a business owner or sole proprietor. Regardless of how meticulously you file, there’s always a chance that you’ll be audited by the Internal Revenue Service. In fact, roughly 1 in every 220 individuals were audited in 2020.

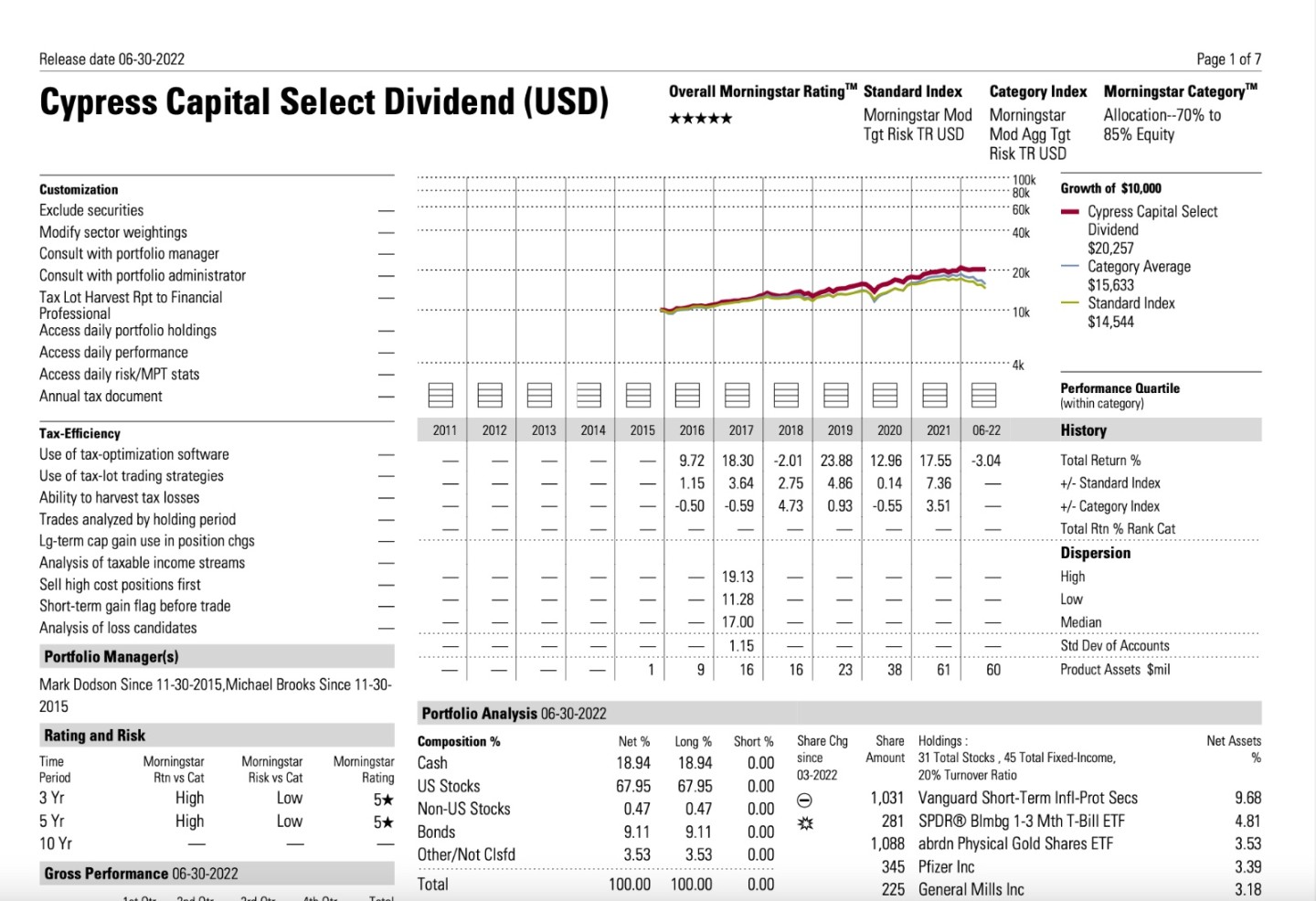

Select Dividend receives Morningstar's 5-Star Rating 2022.

Select Dividend Portfolio: 5 Star Rating From Morningstar

Municipal Bonds: Investing Opportunity After Recent Weakness

Income from municipal bonds award investors with tax advantages. Investors receive steady income exempt from federal taxation.

Check out the recent Redfin article we were featured in:

A pied à terre is a luxury apartment or condo in a big city that someone uses as their second home. People generally invest in pieds à terre for convenience, proximity to work, to visit a particular city, or as a home away from home. Read on to learn about where you can find pieds à terre and how you can choose one that makes the most sense for you.