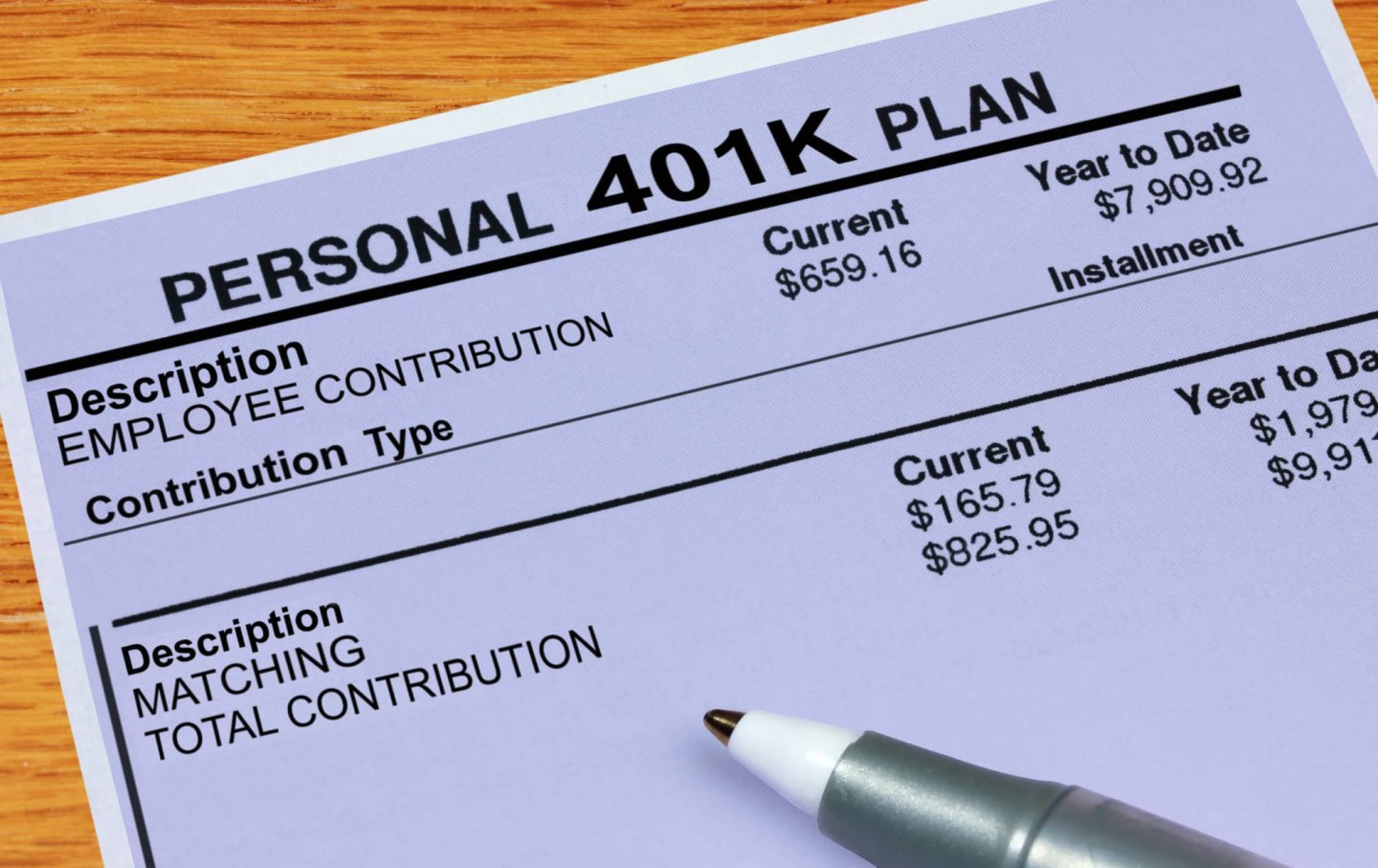

When first considering your investment options, many people decide to utilize a 401(k) for their retirement plans. This is often due to an appealing employer's plan for company matching. Unfortunately, if you leave the company where your 401(k) resides for any reason other than retirement, you'll need to take action regarding 401(k) rollover.

How to start investing

Investing can be intimidating and also seem complex. Knowing where to start for many is the hardest part. No one wants to make mistakes with the assets they will rely upon for retirement

401(k) Rollover Options When Changing Jobs

It’s important to not lose sight of your 401(k) rollover options and your eligibility to move these retirement funds to a rollover IRA.